MAGA = Made America Gilded Again.

Are we living through a New Gilded Age? Similarities between the Great Depression and 2025 are concerning.

In an era where the American Dream is increasingly out of reach for the average citizen, the harsh realities of corporate greed and wealth inequality continue to cast long shadows over the foundational principles of fairness and democracy. Today, we find ourselves at a crossroads strikingly similar to the tumultuous years leading up to the Great Depression. In both cases we have the unchecked accumulation of wealth and power in the hands of a few which not only threatens economic stability but the very fabric of our democratic society.

The parallels are alarmingly clear, a booming stock market and record corporate profits masked the underlying economic fragility faced by the working and middle classes. The concentration of wealth in the upper echelons of society has reached levels not seen since those precarious days, with the top 1% of Americans holding a disproportionate share of the nation's wealth. This new Gilded Age is marked by a blatant disregard for the welfare of the broader population, as corporations prioritize short-term profits over long-term societal well-being. The result is a growing wealth gap that undermines the principle that hard work leads to success, as millions of Americans struggle with stagnant wages, precarious employment, and the rising cost of living. Let’s take a look at some of the biggest offenders in the U.S.

Monopolistic behavior of these top offenders:

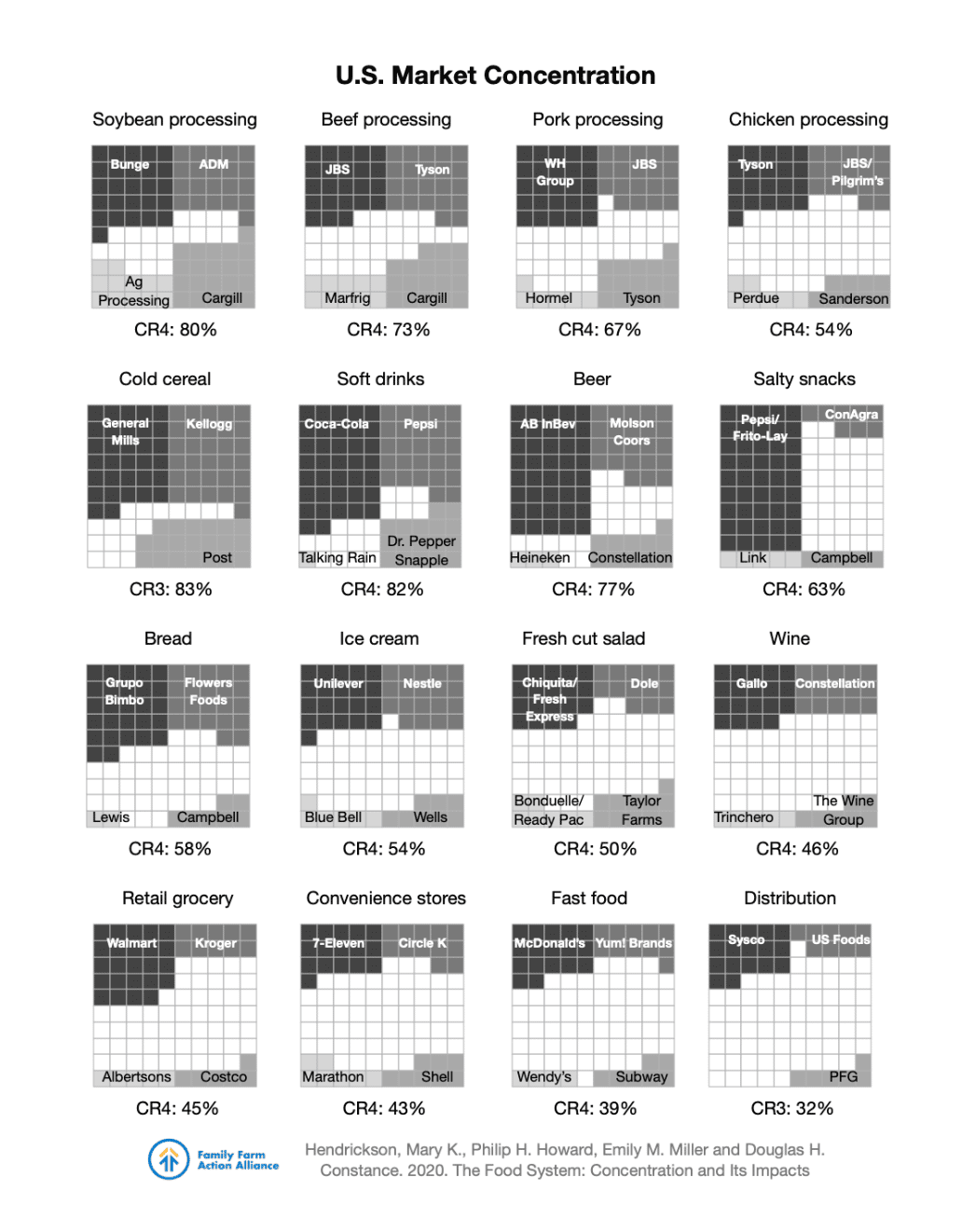

1. Food and Beverage

The largest five food and beverage corporations—Nestlé, PepsiCo, Coca-Cola, Unilever, and Mondelez—control over 40% of the global food market. For example, Nestlé owns more than 2,000 brands in various segments, including 30% of the global bottled water market. These major players can dictate pricing to suppliers and use their scale to outcompete smaller brands, limiting consumer choices and driving up prices.

Beer Industry: Anheuser-Busch InBev controls around 31% of the global beer market after acquiring SABMiller. The five largest beer companies—Anheuser-Busch, Heineken, Carlsberg, Molson Coors, and Asahi—control over 60% of the market.

2. Telecommunications and Media

The top five U.S. telecom companies—AT&T, Verizon, Comcast, T-Mobile, and Charter Communications—control more than 90% of the U.S. broadband and mobile services market. This concentration stifles diversity in media, limits content variety, and inflates prices for consumers across internet services and content delivery.

Media Industry: After mergers like Disney’s acquisition of 21st Century Fox, Disney, Comcast (NBCUniversal), Warner Bros. Discovery, ViacomCBS, and Sony dominate the global media landscape, controlling nearly 85% of film production and distribution.

3. Pharmaceuticals

The five largest pharmaceutical companies—Pfizer, Roche, Johnson & Johnson, Merck, and Novartis—control over 25% of the global drug market. For example, Pfizer alone controls 6.7% of the market. Consolidation in pharmaceuticals leads to less competition for essential drugs, contributing to skyrocketing drug prices and fewer incentives for innovation, especially in niche markets.

4. Technology

Big Tech firms—Apple, Google (Alphabet), Amazon, Microsoft, and Facebook (Meta)—collectively control over 90% of key technology sectors such as online advertising (Google and Facebook account for 60% of the market), cloud computing (Amazon AWS controls 34%, with Microsoft Azure and Google Cloud sharing another 30%), and smartphone operating systems (Android and iOS make up 99.9% of the global market). The dominance of Big Tech creates an environment where smaller companies find it nearly impossible to compete. These companies can buy out potential competitors or use their platforms to undercut competition, leading to monopolistic practices and fewer consumer choices.

Impact on Competition: Consolidation in these industries reduces competition, increases prices, and limits innovation. Consumers face fewer choices and higher costs, while small businesses and startups find it challenging to survive or enter these markets.

5. Retail

Amazon and Walmart dominate U.S. retail, with Amazon holding 47% of the e-commerce market, and Walmart holding around 10% of the total U.S. retail market. Combined, the five largest U.S. retailers—Amazon, Walmart, Costco, Home Depot, and Walgreens—control nearly 60% of the U.S. retail market. These companies’ ability to leverage economies of scale, dictate terms to suppliers, and provide aggressive pricing drives smaller retailers out of the market. In particular, Amazon’s monopolistic hold on e-commerce stifles innovation and competition.

The Machinery of Influence: Lobbying and Special Interests

The influence of corporate greed extends beyond economic disparities, entrenching itself in the very mechanisms of our democracy through lobbying and the activities of special interest groups. These entities pour billions of dollars into the political system to shape legislation and regulation in their favor, often at the expense of public interest. The consequence is a political environment where Wall Street issues drown out Main Street concerns, as policymakers prioritize the agendas of their wealthiest constituents and corporate backers. This manipulation of the democratic process not only disenfranchises average Americans but also erodes trust in governmental institutions, threatening the foundational principles of transparency, accountability, and representation.

Never-ending Greed, History of Capitalism Repeats Itself

America’s economy has always swung between two poles: periods when private empires stitch markets into monopolies, and reform waves that break them back into the many. The first great consolidation of monopoly power, the Gilded Age, ended only after Congress passed legislation that protected the greater economic good. The Sherman Act (1890) and the Supreme Court forced Standard Oil’s breakup in 1911, a defining moment that said bigness serving itself, not the public, must yield to competition. In the late New Deal, antitrust’s mission was re-ignited under Thurman Arnold, who used the law not just to punish cartels but to keep markets structurally open. The next major reset came in telecom: after years of litigation, AT&T divested its local phone monopoly in 1984, demonstrating that breakups could catalyze innovation, lower prices, and unleash adjacent industries.

By the 1980s–2010s, enforcement narrowed under a more permissive, price-centric view of antitrust, even as tech and finance consolidated. The Microsoft case (1998–2001) ended in a conduct remedy rather than a breakup, and a wave of mega-mergers rolled on. That pendulum started to swing back in the 2020s. The DOJ and FTC rewrote the 2023 Merger Guidelines to scrutinize dominance earlier in market lifecycles and to consider harms beyond short-term prices like foreclosure of rivals and the cumulative effects of serial deal-making.

The federal government also brought the most consequential Big Tech cases since Microsoft: the DOJ’s search monopoly suit against Google produced a 2024 liability ruling and a 2025 remedies phase that is now forcing limits on the default-deal machinery that guarded Google’s dominance. In parallel, the DOJ and a bipartisan coalition of states sued Apple in 2024 over conduct alleged to lock in smartphone power—an active case that survived a motion to dismiss in mid-2025. Not every push has succeeded; regulators failed to block Microsoft’s acquisition of Activision on appeal in 2025, underscoring that the courts remain a mixed venue and that merger control is still contested terrain.

So where are we in the cycle? Historically, America stiffens its antitrust spine only after concentrated power starts setting the rules for everyone else. By that measure, we are in the early-middle of a corrective phase: liability findings and tougher merger guidance signal a turn, but the industrial structure—especially in digital platforms, health care intermediaries, parts of finance, and critical supply software—still reflects decades of permissive consolidation. The current moment looks less like 1911’s clean break or 1984’s landmark divestiture and more like the early New Deal period, when policy and courts were renegotiating the bounds of private power.

The outcome will hinge on three levers: (1) whether courts continue to accept broader theories of competitive harm embedded in the 2023 Guidelines; (2) whether remedies (including structural ones) actually restore competitive conditions rather than merely police behavior; and (3) whether enforcers can keep pace with serial acquisition strategies in fast-moving tech markets. If those levers pull in the public’s direction, this cycle could rhyme with earlier busts of monopoly power; if not, we risk a plateau in which headline victories coexist with entrenched dominance that subtly taxes innovation, labor, and consumers alike.

A Call to Action: Reclaiming Democracy

To combat the insidious effects of corporate greed and wealth inequality, a multi-faceted approach is necessary:

Campaign Finance Reform: Enact stringent campaign finance laws to limit the influence of money in politics, ensuring that elected officials serve the interests of their constituents, not corporate donors.

Strengthening Regulatory Frameworks: Implement and enforce robust regulatory measures that curb monopolistic practices, promote fair competition, and protect consumers and small businesses.

Progressive Taxation: Adopt a progressive tax system where those at the top contribute their fair share, supporting public services and infrastructure that benefit all, not just a privileged few.

Promoting Corporate Accountability: Encourage ethical business practices through transparency and accountability measures, holding corporations responsible for actions that undermine public welfare and economic stability.

As we stand at this critical juncture, the need for decisive action has never been more urgent. It's time to dismantle the mechanisms that allow corporate greed to thrive at the expense of American workers and to reform a society that values dignity, equity, and the common good above profit. Together, we can reclaim the promise of America for every citizen, building a future where democracy flourishes in the service of the people, not the privileged few. The time for change is now, let us be the architects of a more just and equitable nation.